Adjusted BalanceYour Total Balance, including Plan It or Pay Over Time payments. Go paperlessYou can choose to enroll in paperless delivery of your statements and account communications by logging into your digital account and navigating to Account Preferences. Then you’ll receive statements and communications online and receive helpful account alerts straight to your inbox. Closing balance of Cash in Hand for the year 31st March,2021 was ₹7,000.

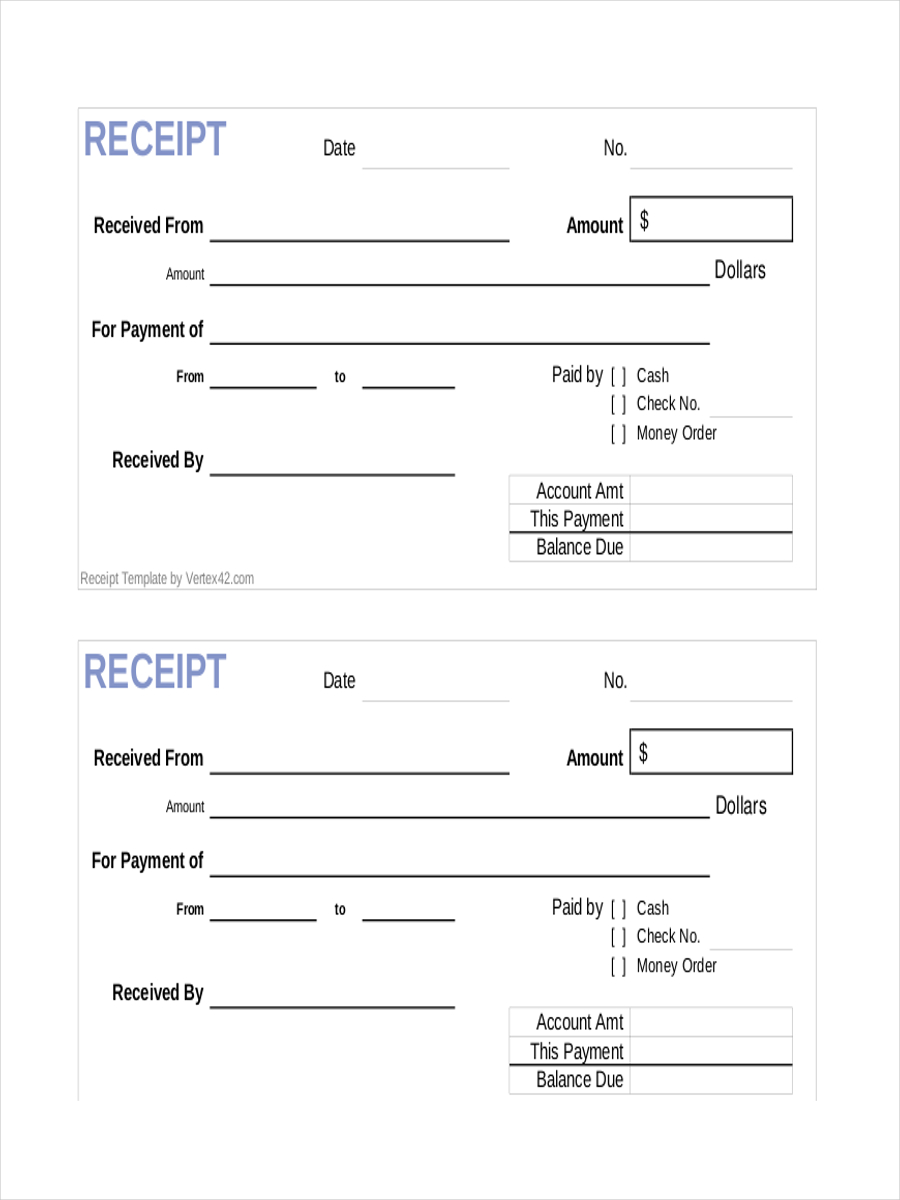

Receipt and Payment Account Format

- However, there is no distinction between cash and bank transactions, so the final amount may represent the cash in hand, cash at the bank, or even both.

- It does not distinguish between capital and revenue receipts and payments, and records all cash and bank transactions, including capital and revenue.

- You do not need to go into too much depth with each one of these reviews just enough so that you can identify any major changes in the figures.

- Given that the receipts and payments account is simply a summary of cash transactions, it does not cover outstanding income or expenditure.

Both the Receipt and Payment Account and the Income and Expenditure Account are financial statements that summarize a company or organization’s financial activity over a certain period of time, typically a fiscal year. A Receipt and Payment Account is a financial statement that is used to record all of the financial transactions of an organization, such as receipts (income) and payments (expenditures). Receipt and Payment Account focuses on cash transactions, excluding non-cash items, while an Income Statement includes all revenues and expenses, whether cash-based or not. In simpler terms, it’s like a wallet diary for a group or organization. Imagine you jot down every time you receive money (like payments from customers, donations, or loans) and every time you spend money (like buying supplies, paying salaries, or settling bills).

Example of Income And Expenditure Account

On the other hand, the income and expenditure account reflects the income and expenditure of the current year of the non-profit organization. Do you know non-profit organizations don’t need to maintain a large set of books of accounts? However, they need to prepare financial statements at the end of every financial year. So, for this purpose, they prepare receipt and payment accounts and income and expenditure accounts and a Balance Sheet. Under accrual basis accounting, all economic transactions whether they involve cash or not are recorded in books of accounts. This method is mostly used because it provides more accurate information about business transactions and allows the company to make better financial decisions.

What are the similarities between Receipt And Payment Account and Income And Expenditure Account

Remember that this account focuses exclusively on cash transactions and does not account for non-cash items or overall profitability. The receipt and payment account cannot disclose the true result of a non-profit organization. We prepare this account on the basis of the information available from the cash book. The Receipts and Payments account is a real account that reflects cash transactions occuring during the financial year. In addition, it is similar to the cash book of profit-making organizations.

This accounting method is used to give more detailed information about business transactions and allows companies to make better financial decisions. Receipt and payment account does not include any non-cash transactions such as depreciation. The Receipt and payment account is prepared at the end of an accounting period. A receipts and payments account is prepared by extracting receipts and payments from the cash book for the entire year. These accounts show cash positions only, not surpluses or deficits for the period. They generally show debit balance, and in case of a bank overdraft, the bank balance will be credit.

How much are you saving for retirement each month?

what is a single step income statements are necessary to fulfil various governmental oversight norms. They also highlight the direction in which an NPO is going financially. As a club, their main revenue will be from collecting subscription fee from their members.

You have understood the overview of receipt and payment account format, but what about the benefits? First, a receipts and payments account is a summarized form of a cash book. It starts with an opening cash and bank balance (sometimes the two are merged) and ends with their closing balances. All the receipts are written on the debit side, and all the payments made are written on the credit side of the account. Receipt and Payment A/c fairly depicts the position of cash of an organisation. While receipt and payment account is a simple summary of cash and bank transactions.

The best way to learn is through repetition so make sure to review your notes on the Receipt and Payment Account often. This will help embed the information in your mind making it easier for you to use. 8) Review notes often- The best way to learn is through repetition so make sure to review your notes on the Receipt and Payment Account often.

The organizations can be colleges and universities, hospitals, libraries, religious organizations, welfare societies, foundations, political parties, trade associations, professional associations and so forth. 7) Compare budget with actual figures- Once you have gathered all the relevant data from your Receipt and Payment Account, compare it against your budgeted figures. This will help give you an idea whether or not you are on track to achieving your financial goals. Based on standard Receipts and Payments Format, here is the balanced table of accounts. If you bring forward the ending balance, then the subscription account will now looks like this. (I showed this because I think most people will get confused on which entry should you put owing b/d or prepaid b/d).

Now that you have a receipts and payments format, here is a solved example for students of commerce. Instead of calling profit and loss account, the name for profit and loss account has been changed to income and expenditure account. There are the same thing, but you will need to use income and expenditure account for non-profit organisation. Receipts are nothing but the incoming of money or money equivalents. On the other hand, Payments refer to the disbursement of cash or cash equivalents to another party.

Receipt & Payment A/c is a real account, which records cash transactions and events of a Not for Profit Organisation. Receipt & Payment A/c records receipts and payments which are settled in cash of both capital and revenue nature or whether it relates to the current year, previous year or next year. It is prepared for a specific period and it is not based on the accrual system of accounting, i.e., it does not include expenses or income on an accrual basis. A receipt and payment account is a financial statement that shows the cash inflows and outflows of an organization or individual over a specific period of time, such as a month or a year. It lists all cash receipts and payments, including cash sales and purchases, on the left and right sides, respectively.