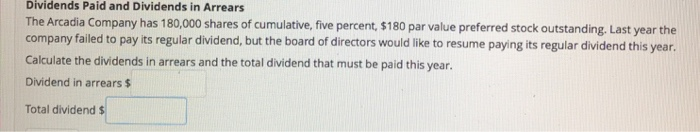

Shareholders expect companies to make regular dividend payments, especially those holding preferred stock. Finally, calculate total dividends in arrears by multiplying the quarterly expected dividend payment by the number of missed payments. This is the amount that must be paid out before common stockholders are issued dividends. Typically, the corporation’s board of directors will not declare a dividend they will be omitting.

Which of these is most important for your financial advisor to have?

All of our content is based on objective analysis, and the opinions are our own. The participation rate of 0.4% was found by dividing the excess over the second threshold ($16,000) by the total par value ($4,000,000). Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Remember, informed decisions lead to smarter investments and ultimately shape financial success.

Canadian Investment Regulatory Organization Trade Resumption – KNE

Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock account. While preferred stock and common stock are both equity instruments, they share important distinctions. First, preferred stock receive a fixed dividend as dividend obligations to preferred xero new reports and xero budget manager shareholders must be satisfied first. Common stockholders, on the other hand, may not always receive a dividend. A company may fully pay all dividends (even prior years) to preferred stockholders before any dividends can be issued to common stockholders. If a company issues non-cumulative preference shares, dividends on those shares are not cumulative.

Canadian Investment Regulatory Organization Trade Resumption – VRNO

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

After the dividends are paid, the dividend payable is reversed and is no longer present on the liability side of the balance sheet. When the dividends are paid, the effect on the balance sheet is a decrease in the company’s retained earnings and its cash balance. In other words, retained earnings and cash are reduced by the total value of the dividend. We continued to manage our portfolio in a declining interest rate environment.

Voting Rights

Common stockholders are last in line and often receive minimal or no bankruptcy proceeds. At this point you have learned all of the accounts and calculated amounts that are shown below on the income statement, retained earnings statement, and balance sheet. Understanding what these accounts are and how their balances are determined provides you with a sound foundation for learning managerial accounting concepts.

Not paying dividends also carries more serious consequences like legal trouble or breaking rules set by regulators. Companies must handle this carefully or they risk facing serious penalties that could harm their reputation and financial standing even more. When two parties come to an agreement in a contract, payment is usually made before or after a product or service is provided. Payment made before a service is provided is common with rents, leases, prepaid phone bills, insurance premium payments, and Internet service bills.

Nothing was declared or paid, so another $1,000 was put into arrears. Dividends in arrears don’t earn interest and thus don’t grow in a compound interest convention; they only accumulate from additional nonpayments of the preferred dividend. Furthermore, many preferred stocks accrue unpaid dividends for only a limited number of years (such as 3, 5, etc), but those unpaid dividends remain due until they are paid.

These unpaid dividends are frequently referred to as “omitted preferred dividends”. For example, say a company has 100,000 shares outstanding and wants to issue a 10% dividend in the form of stock. If each share is currently worth $20 on the market, the total value of the dividend would equal $200,000. The two entries would include a $200,000 debit to retained earnings and a $200,000 credit to the common stock account. Retained earnings are the amount of money a company has left over after all of its obligations have been paid. Retained earnings are typically used for reinvesting in the company, paying dividends, or paying down debt.

- Based in St. Petersburg, Fla., Karen Rogers covers the financial markets for several online publications.

- If word gets out that a company can’t pay up, investor attraction drops sharply.

- Preferred shares have less potential to appreciate in price than common stock, and they usually trade within a few dollars of their issue price, most commonly $25.

Understanding dividends in arrears is crucial for anyone with a stake in the stock market. They show how a company’s past due dividends can affect future payments to shareholders. If you hold cumulative preferred stock, knowing about these arrears helps you figure out your potential returns. Moving from how dividends in arrears relate to preferred shares, let’s explore what happens if a company doesn’t have enough cash to pay these dividends.