In each of those years, the preferred stockholders receive the first $75,000 and the common stockholders receive the remainder. Since preferred stockholders are entitled to receive the first $75,000 in each year, they receive the entire amount of the dividend declared and the common shareholders receive nothing. Under the terms of this arrangement, any amounts of preferred dividends not declared in a given year are carried forward into the future. They must be paid in total before any dividends are paid to common stockholders. As the cumulative feature reduces the dividend risk to investors, cumulative preferred stock can usually be offered with a lower payment rate than required for a noncumulative preferred stock.

What Are Preference Shares and What Are the Types of Preferred Stock?

Even bondholders are higher in line since their investment represents secured credit. In addition, owners of common shares have voting rights and may participate in major business decisions if they choose. The ultimate effect of cash dividends on the company’s balance sheet is a reduction in cash for $250,000 on the asset side, and a reduction in retained earnings for $250,000 on the equity side.

What Is Preferred Stock?

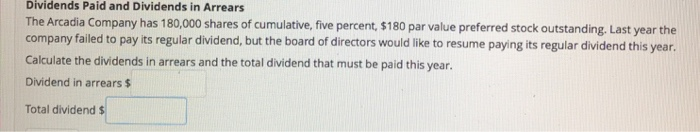

For them, cumulative preferred stocks can be less risky and more rewarding even when times are tough for the business. It decides not to pay out dividends for now and use all its cash for expansion instead. The unpaid dividends stack up as deferred payments that will need clearing later on, heading towards becoming delinquent if not addressed in time. Multiply the annual dividend payment per share by total shares issued to find the total expected annual dividend payment.

- As the cumulative feature reduces the dividend risk to investors, cumulative preferred stock can usually be offered with a lower payment rate than required for a noncumulative preferred stock.

- This type of equity investment represents ownership of a company and results in prioritized treatment for dividend distributions.

- However, preference shares will generally have lower priority than corporate bonds, debentures, or other fixed-income securities.

- As mentioned, dividends in arrears don’t apply to every type of stock.

Understanding Cumulative Preferred Stock

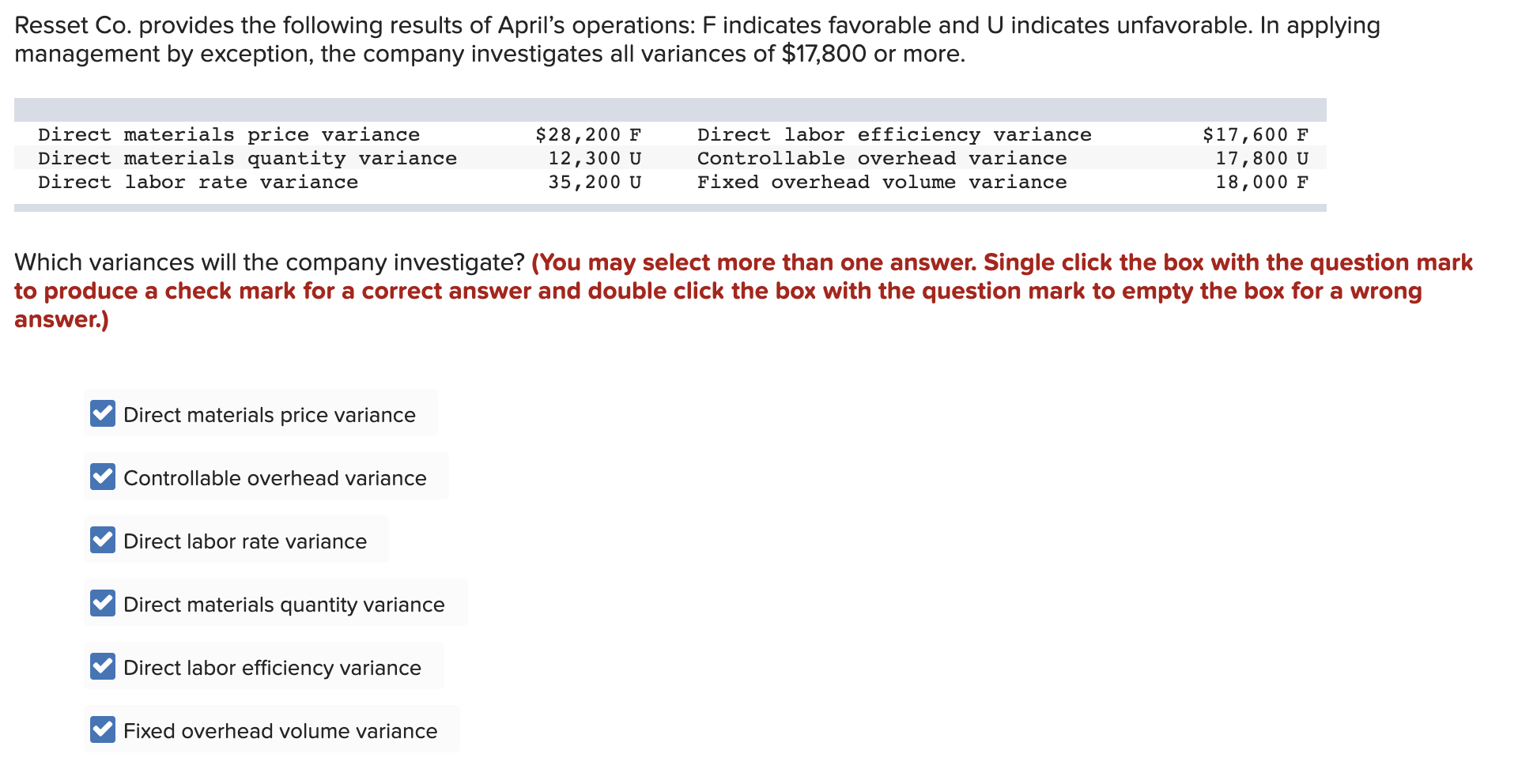

It can be paid in the latter year with the arrear of the past year without any interest. We are committed to a strategy of managing controllable factors to protect our bottom line and taking advantage of opportunities that arise in the current market environment. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

What Is Cumulative Preferred Stock?

It’s vital for investors to grasp what happens when corporations fall behind on their dividend obligations. A vote to suspend dividend payments is a clear signal that a company has failed to earn enough money to pay the dividends it has committed to paying. At the very least, some of its obligations, such as payments to regular suppliers, may be more urgent. If a company has dividends in arrears, it usually means it has failed to generate enough cash to pay the dividends it owes preferred shareholders.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, cash flow frog university instructor, and innovator in teaching accounting online. Arrears refers to a debt or payment that is still outstanding after the payment due date has passed. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

If they fail to receive the maximum, common stockholders receive no dividends at all. For example, companies issue a prospectus to shareholders that gives information about dividend payments. However, companies can’t always issue the dividends they promise, even to preferred shareholders. You don’t have to worry about any complicated calculations to determine your dividends. For preference shares, companies list the amount of their dividend payments in their financial filings.

Then, companies may issue dividends similar to how bonds issue coupon payments. Though the mechanism is different, the end result is ongoing payments derived from an investment. Preferred stockholders typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares, but not vice versa.

Since $200,000 is declared, preferred stockholders receive $120,000 of it and common shareholders receive the remaining $80,000. Cumulative preferred stock is unique in that it has the right to claim a minimum distribution each year. The board of directors annually makes the decision to declare and pay dividends to shareholders. If nothing is declared or paid, the cumulative shareholders don’t get a payment for the year. There can be cash left over after preference shareholders receive payment.